MANDATE

- To promote quality services in Human Resources;

- To ensure outstanding service to all our employees;

- To create an environment supportive of professional development;

- To create a working environment that fosters success, promotes positive attitudes, collaboration and a shared vision.

- Job Opportunities

Payroll Information

Instructions on how to access your electronic pay stub

If you have been absent, please complete an absence form and send to payroll_HR@rsb.qc.ca for processing. The appropriate codes are referenced below:

Support staff overtime – Please record using this form.

Professionals compensation time – Please record using this form.

Should you have any questions related to payroll, please send all inquiries to payroll_HR@rsb.qc.ca.

Request for change of address

If you are moving and would like to request a change of address, please include the following information for us to update your file:

- Full name

- Current address we have on file

- New address

Employment Insurance Benefits (EI)

- How to declare your salary for employment insurance benefits

- Example part time teacher

- Calculation sheet – Teachers

To request a record of employment (ROE), please send an email to payroll_HR@rsb.qc.ca.

For more information regarding claims or any questions regarding employment insurance benefits, please contact Service Canada.

Group Insurance Benefits

Requests for Letters of Employment

Should you require a letter of employment or experience, please complete this request form. Human resources will email you a PDF copy of the requested letter within 48 business hours.

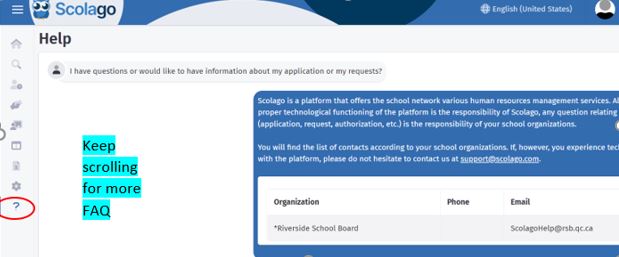

Scolago (substitution management platform)

Please log in to your account using your Microsoft 365 email. Once you are logged in, there is a help section with answers to frequently asked questions as well as several short tutorial videos. Should you still need assistance following the consultation of the help section in Scolago, please send an email with your inquiry to scolagohelp_HR@rsb.qc.ca.

Professional Improvement (PIC)

Please consult the guidelines related to the different professional improvement committees:

- PIC Guidelines – Teachers

- PIC Guidelines – Professionals

- PIC Guidelines – Support Staff Local 576

- PIC Guidelines – Support Staff Local 800

- PIC Guidelines – Administrators

Request forms to attend a professional development activity:

Request forms | Tuition Fees:

Please send all requests and questions related to professional improvement to PIC_HR@rsb.qc.ca.

Retirement Information

- For all information related to retirement please consult the Retraite Québec website.

- To consult a guide prepared by Retraite Québec on buy back service information, please click here.

- Click here to access a Retraite Québec Application for a buy-back of one or more periods of absence (Public-Sector Pension Plan).

- Should you wish to apply for a progressive retirement, please fill in this request form and send to Human Resources.

Please send all requests and questions related to retirement to pension_retirement_resignation_HR@rsb.qc.ca.

Leave of Absence

Please note that employees who wish to apply for a leave of absence without pay (part-time or full-time) for the 2023-2024 school year or wish to apply for a sabbatical leave with deferred salary plan beginning as of the 2023-2024 school year, should complete the appropriate form and submit it to their immediate superior, in enough time for it to be forwarded to the Human Resources Department by the following deadlines:

Before March 1, 2023 Administrators, teachers and professionals

Before May 1, 2023 Support staff

For details on eligibility, please refer to our policy on leave of absences without salary and sabbatical leaves with deferred salary.

- Request for a part-time leave of absence (without pay)

- Request for a full-time leave of absence (without pay)

- Request for a sabbatical leave with deferred salary (teachers)

- Request for a sabbatical leave with deferred salary (non-teachers)

Please send all requests and questions related to leave of absences to LOA_HR@rsb.qc.ca.

Parental Leaves

In addition to the information below regarding your parental leave, please consult the Quebec Parental Insurance Plan for detailed information regarding maternity/paternity/parental leave benefits https://www.rqap.gouv.qc.ca/en/home.

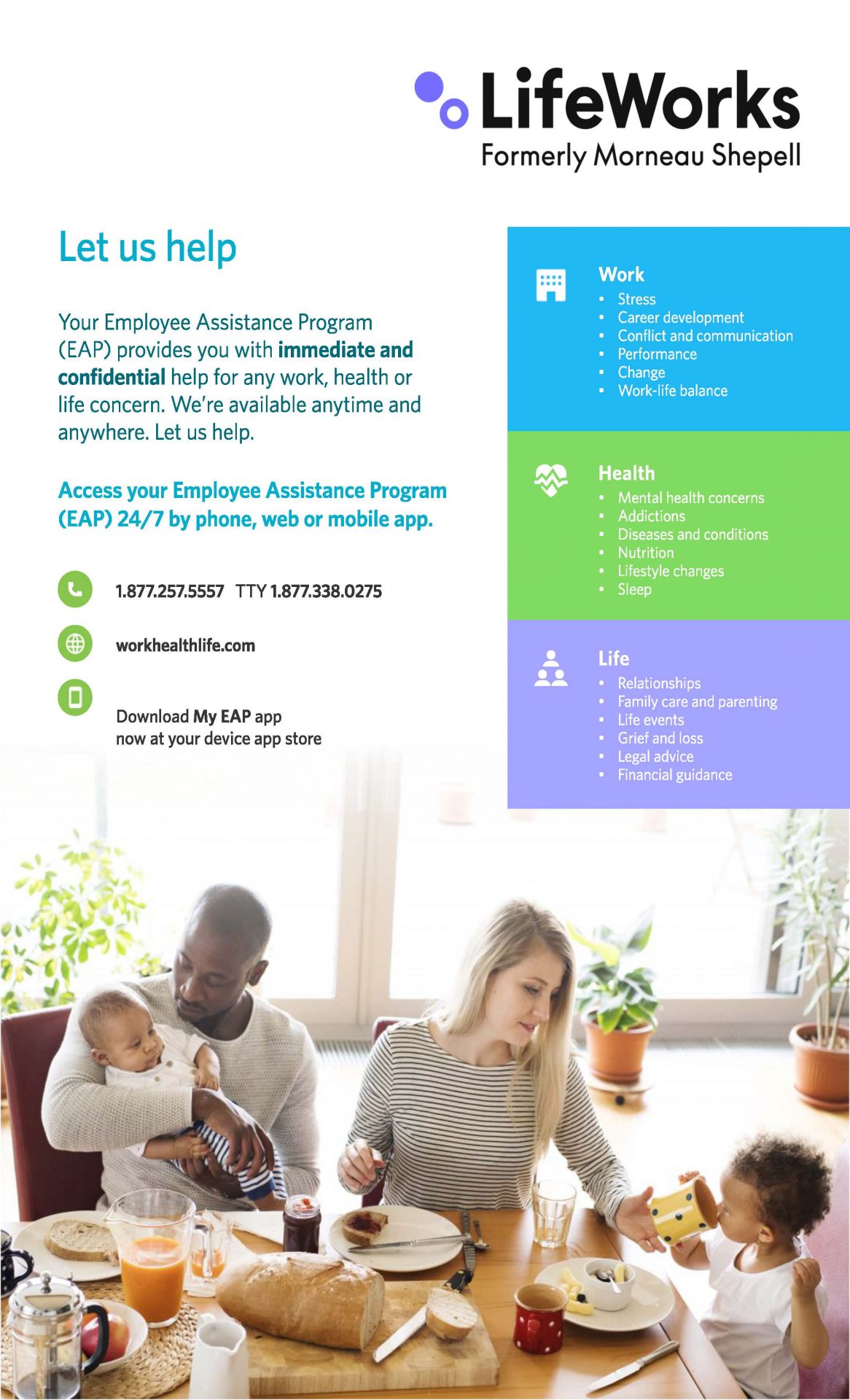

Employee Assistance Program

To visualize the poster in PDF

Workplace accidents and preventative leave | CNESST

If you have had a work accident or require information related to CNESST, please contact CNESST_HR@rsb.qc.ca

Medical Leave & Salary Insurance

Important information regarding salary insurance

Should you be unable to work due to medical reasons, please communicate with the Human Resources department at medicalleave_HR@rsb.qc.ca.

Collective Agreements

- Teacher Collective Agreement

- Professional Collective Agreement – Waiting for translation

- Support Staff Local 576 Collective Agreement – waiting for translation

- Support Staff Local 800 Collective Agreement – waiting for translation

- International Mobility Program Employees

Classification Plans

Contact Us

For any other inquiries, please contact HR@rsb.qc.ca.